Page 129 - Annual Report 2016 EN

P. 129

129 |

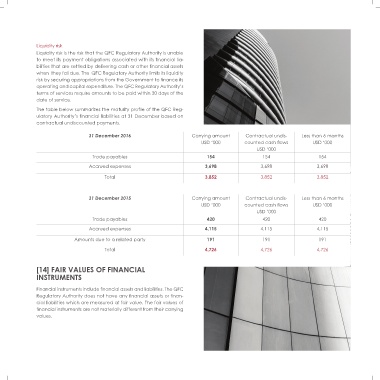

Liquidity risk

Liquidity risk is the risk that the QFC Regulatory Authority is unable

to meet its payment obligations associated with its financial lia-

bilities that are settled by delivering cash or other financial assets

when they fall due. The QFC Regulatory Authority limits its liquidity

risk by securing appropriations from the Government to finance its

operating and capital expenditure. The QFC Regulatory Authority’s

terms of services require amounts to be paid within 30 days of the

date of service.

The table below summarizes the maturity profile of the QFC Reg-

ulatory Authority’s financial liabilities at 31 December based on

contractual undiscounted payments.

31 December 2016 Carrying amount Contractual undis- Less than 6 months

USD ‘000 counted cash flows USD ‘000

USD ‘000

Trade payables 154 154 154

Accrued expenses 3,698 3,698 3,698

Total 3,852 3,852 3,852

31 December 2015 Carrying amount Contractual undis- Less than 6 months

USD ‘000 counted cash flows USD ‘000

USD ‘000

Trade payables 420 420 420

Accrued expenses 4,115 4,115 4,115

Amounts due to a related party 191 191 191

Total 4,726 4,726 4,726

[14] FAIR VALUES OF FINANCIAL

INSTRUMENTS

Financial instruments include financial assets and liabilities. The QFC

Regulatory Authority does not have any financial assets or finan-

cial liabilities which are measured at fair value. The fair values of

financial instruments are not materially different from their carrying

values.