Page 44 - Annual Report 2016 EN

P. 44

| 44

a. Corporate Banks

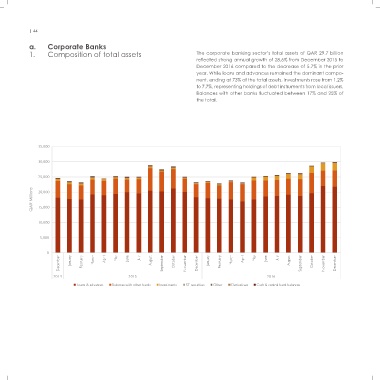

1. Composition of total assets The corporate banking sector’s total assets of QAR 29.7 billion

reflected strong annual growth of 28.6% from December 2015 to

December 2016 compared to the decrease of 5.7% in the prior

year. While loans and advances remained the dominant compo-

nent, ending at 73% of the total assets, investments rose from 1.2%

to 7.7%, representing holdings of debt instruments from local issuers.

Balances with other banks fluctuated between 17% and 25% of

the total.

Total assets

35,000

30,000

25,000

QAR Millions QAR Millions 20,000

15,000

10,000

5,000

0 July July

December January February March April May June August September October November December January February March April May June August September October November December

2014 2015 2016

Loans & advances Balances with other banks Investments ST securities Other Derivatives Cash & central bank balances