Page 65 - Annual Report 2016 EN

P. 65

65 |

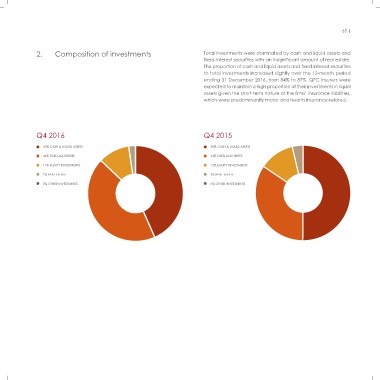

2. Composition of investments Total investments were dominated by cash and liquid assets and

fixed-interest securities with an insignificant amount of real estate.

The proportion of cash and liquid assets and fixed-interest securities

to total investments increased slightly over the 12-month period

ending 31 December 2016, from 84% to 87%. QFC insurers were

expected to maintain a high proportion of their investments in liquid

assets given the short-term nature of the firms’ insurance liabilities,

which were predominantly motor and health insurance-related.

Q4 2016 Q4 2015

43% CASH & LIQUID ASSETS 50% CASH & LIQUID ASSETS

44% FIXED MATURITIES 34% FIXED MATURITIES

11% EQUITY INVESTMENTS 12% EQUITY INVESTMENTS

2% REAL ESTATE 4% REAL ESTATE

0% OTHER INVESTMENTS 0% OTHER INVESTMENTS